Submitting Claims in the New Platform

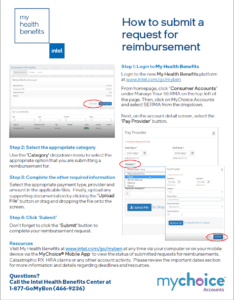

Intel is transitioning to a new My Health Benefits platform vendor and should be complete by Jan. 21, 2022. Once your SERMA balance is transferred and updated in My Health Benefits Web site on January 21, 2022, you will be able to submit 2021 claims to MyChoice Accounts until May 31, 2022. You will also need to re-enroll in auto pay and auto-reimbursement. The attached file details how best to submit claims in the new system:

- All receipts and claims must be filed by the run-out period of May 31 of the following year. For example, 2021 receipts are due May 31, 2022.

- You have the option to use SERMA to pay for all or part of your IRMP premium or to reimburse yourself for the cost of other eligible health insurance premiums. There are flexible options for filing monthly, quarterly, or even yearly.

- Intel reserves the right to terminate your SERMA. Your SERMA account will be considered inactive if not used in 20 consecutive years and will be terminated when you or your eligible dependents die.

- You may have two SERMA accounts based on various separation programs, they work together. Your total credits can be used for your eligible medical premium reimbursements.

- See SPD Summary Plan Description for full details on using your SERMA balance for your eligible dependents after your death. Print and save with your estate planning documents.

Important! SERMA Opt-Out/Opt-In for non-Medicare eligible retirees

- You may opt-out of SERMA for the year if you are a non-Medicare retiree and you determine that you are eligible for federal premium tax credits.

- Non-Medicare retirees with access to SERMA may not qualify to receive federal premium tax credits to reduce the cost of health insurance purchased through an eligible exchange If you are considering using Federal premium tax credits to reduce the cost of health insurance purchased through your eligible exchange, you should seek guidance from a tax advisor.

If you are not Medicare-eligible and you determine that you are eligible for the Federal premium tax credit, you may “Opt-Out” of SERMA for the year. When you “Opt-Out,” your SERMA balance is frozen and you will not be able to use SERMA to pay for Intel or non-Intel sponsored healthcare premiums mentioned above for you or your dependents. You may choose to “Opt-Out” of SERMA on two occasions: upon initial retirement, within 31 days of your initial retirement, for the remainder of the current calendar year and during Annual Enrollment for the following calendar year. You must call the Intel Health Benefits Center to “Opt back IN”. Click here to learn more about this option.

If you are not Medicare-eligible and you determine that you are eligible for the Federal premium tax credit, you may “Opt-Out” of SERMA for the year. When you “Opt-Out,” your SERMA balance is frozen and you will not be able to use SERMA to pay for Intel or non-Intel sponsored healthcare premiums mentioned above for you or your dependents. You may choose to “Opt-Out” of SERMA on two occasions: upon initial retirement, within 31 days of your initial retirement, for the remainder of the current calendar year and during Annual Enrollment for the following calendar year. You must call the Intel Health Benefits Center to “Opt back IN”. Click here to learn more about this option.

For more information, refer to the My Health Benefits or contact the Intel Health Benefits Center at (877-466-9236), Monday through Friday, 5 a.m. to 6 p.m. (PST), ask to speak to a representative.

New 2022 SERMA Program Links

|