Where can I go to get Intel Retiree COBRA questions answered?

If you have questions about your COBRA health plan coverage or issues with a medical claim contact the Intel Health Benefits Center at 877-466-9236, Monday – Friday, 7 a.m. to 5 p.m. (Pacific). Through the Intel Health Benefits Center, you may engage a participant advocate

Are COBRA and SERMA credits taxed?

Intel paid COBRA and SERMA are not taxed

Are vision and dental covered under COBRA?

Yes, your COBRA will be based on your medical, dental and vision plan and coverage on the day prior to your retirement

Can I keep my existing health plan under COBRA?

Yes, your COBRA will be based on your medical, dental, and vision plan and coverage on the day prior to your retirement

If I get a job, can I still be on COBRA?

Coverage under another group health plan is an event that will result in the termination of COBRA eligibility. It is your responsibility to provide notice to Aon Hewitt upon enrollment in another group health plan. Verify that you are covered by a group health plan with your new employer prior to notifying AON Hewitt. You can continue your coverage via COBRA even if you are eligible for a new employer’s plan. But, if you waive your new employer’s coverage when it’s offered to you, you will not be able to enroll in your new employer’s plan until the next open enrollment or your next qualifying event. If your new employer does not have a group health plan you can continue COBRA coverage.

What does up to 18 months mean? What determines if you get 18 months’ coverage?

The standard COBRA coverage is 18 months. COBRA eligibility may also be impacted by disability status, enrollment in another group health plan, etc. For more information, review the Intel Pay, Stock and Benefits Handbook, Chapter 11 COBRA

What will happen to my HSA while on COBRA?

Your HSA is yours to take with you following the end of your employment; balances are not forfeited. You may leave the balance with your current administrator or roll over. You may continue to make contributions to your HSA while on COBRA, though you will do so on an after-tax basis. If you are Medicare eligible you can no longer contribute into an HSA

If I’m on Medicare, how will COBRA work?

Once you are eligible for Medicare (Part A and B), COBRA will assume you are enrolled and will reduce payments accordingly. It is very important to enroll in Part A and B to maximize your total coverage. See the COBRA Coverage Ending Due to Medicare” section at the end of the COBRA table found on the COBRA Overview web page

How do I find my COBRA Billing Notice

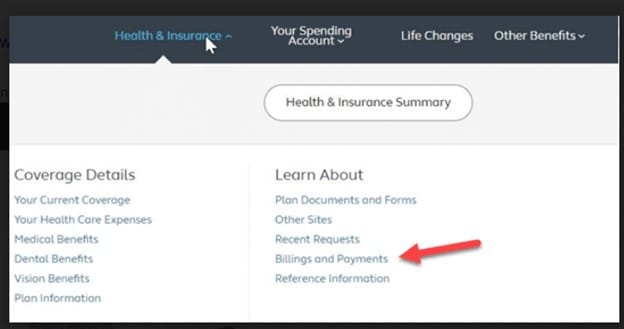

On the Health Benefits View the billing notice online under the Health & Insurance section and then select ‘Billings and Payments

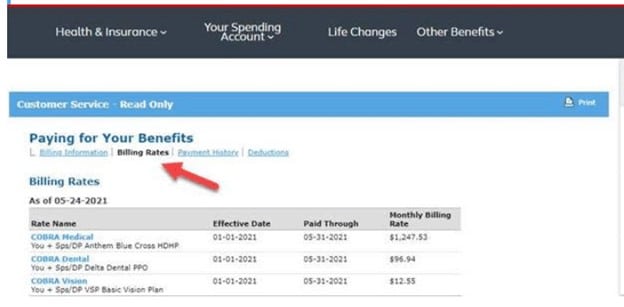

Select ‘Billing Rates’ and it will show COBRA rates with the effective dates and monthly billing rates. Take a screenshot and upload it as supporting documentation to set up recurring claims and include your name by clicking on his profile.

(Example of billing rates as of 05-24-2021)